Discover the World of Angel Investing

By Dima Namashco, CEO at Mozaic

Curious about how to make a mark in the tech startup ecosystem? Angel investing offers an opportunity to not only invest in promising new ventures but also to guide obsessing founders. Let’s explore who angel investors are, why they invest, and return multipliers that can come from these early-stage investments.

Firstly, let’s start with the definition:

An angel investor, sometimes referred to as a business angel, is an individual that invests in early-stage technology startups by offering their capital, knowledge and network (also called “smart money”). In exchange, they receive equity with the hope to make in medium or long term a profitable investment both for themselves and the selected startup through a liquidation event – an acquisition, merger, initial public offering (IPO), or other action that allows early investors in a company to cash out some or all of their ownership shares (also called “Exit Strategy”).

Now, let’s see the motivations behind angel investors. Besides the financial motivation of doing high returns of investment, it can also be some non-financial ones that can vary from any of the following:

- Joy from supporting founders, being a Mentor, Coach, Therapist;

- Building track record for starting an angel network or VC firm;

- Staying current on technology trends;

- Being part of a community;

- Giving back.

On the other side, as an angel investor, you should define your offering for the startup founders. It can be just money, but also you can provide some extra value:

- Knowledge. You have some experience that can help founders out, whether you’re founder yourself, capable of providing guidance or you have some insights or expertise in anything that can be useful for the startup (technology, sales, marketing, finance etc.)

- Network for introductions. For instance, you can connect a startup with a potential customer, employee or investor.

Why is it important to you as an angel investor? Essentially, it builds your brand for attracting new deals. Founders remember everything you do for them on the way up.

Every conversation, every call meeting you make, every intro you write, every advice you share (ofc, when asked), even some things you’ve forgotten about. Ultimately, you might become the first-choice investor that every founder would like to have you on board.

Speaking about financial motivation, angel investing is known for its potential for extraordinary returns. However, it is worth noting that the wealth is generated through Power Law distribution where one single investment is worth exponentially more than all other investments combined, often by orders of magnitude. Historically, this concept originated from the Pareto Principle which states that 80% of consequences come from 20% of the causes. Thus, power law is considered to be a driving force in the high-stakes, high-reward world of venture capital.

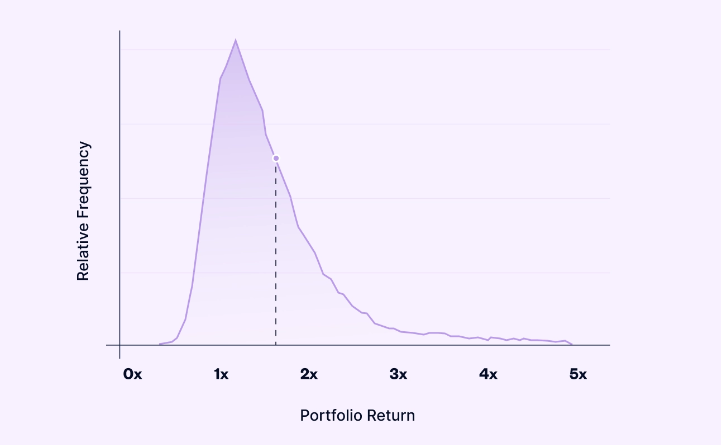

According to AngelList Data where 1808 investments are examined, below you can find the distribution of returns for hypothetical portfolio of 10 investments out of 1808 originally selected:

Source: AngelList Data.

The dotted vertical line represents the market return, which is what you would get from writing an equal-sized check into all of the potential AngelList investments. It shows that a small number of investments generate most of the returns, while most investments have modest or negative returns. It is worth mentioning that the tail of return multipliers does not stop at the 5x shown on the graph but instead keeps going.

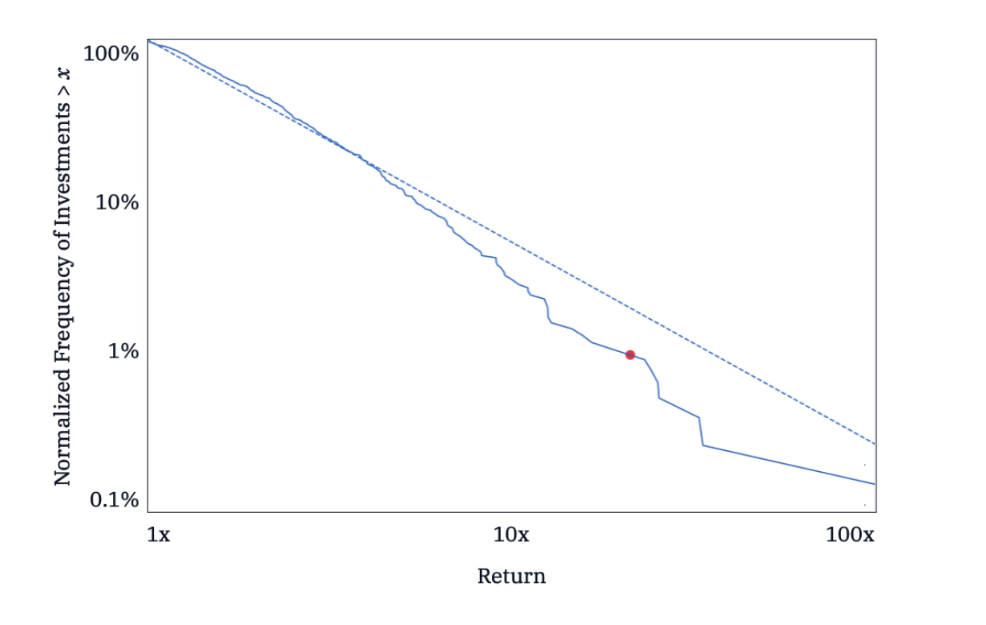

Here is another figure of a power-law distribution that has only positive returns. The x axis is the return multiplier of the investment (i.e., 1x = money returned without profit, 10x = 900% return). The y axis is the fraction of positive investments that generate at least that return multiple.

Source: AngelList Data.

According to the graph, the red dot indicates that 1% of positive investments generate at least a 22x return. This behavior points to the presence of self-organized tipping points in venture capital investments, where a few significant events disproportionately influence the overall system. In this context, to succeed in angel investing, expect to generate low returns before hitting a big win. For that, you have to think of risk not as a chance of failure, but as a chance of an upside success.

In summary, angel investing is a journey that combines financial potential with the joy of supporting visionary founders. By understanding the motivations behind angel investments and recognizing the power law distribution of returns, you can become a key player in shaping the future of startups. Whether you’re in it for the profits, the mentorship, or simply the desire to stay ahead of technology trends, becoming a business angel could be your next great adventure. Embrace the challenge, and who knows? You might just discover the next unicorn.