5 Key Factors we consider when investing in startups

Investing in tech startups that have the potential to become unicorns—valued at over $1 billion—requires careful analysis. Understanding the key factors that contribute to a startup’s success is essential for angel investors. In this post, we outline the most important criteria that our angel investors at Mozaic consider when evaluating investment opportunities in early-stage companies.

1. Founder-Market-Fit

This is the core metric.

Since we are early-stage investors, providing the first round of funding, we understand that the startup is yet to find its Product Market Fit (PMF). Thus, we focus on Founder Market Fit to assess potential pre-seed or seed investment. Here are specific aspects that are attractive to the investors:

– Domain Expertise: this means that the founders are building something for themselves or starting a company in a sector where they have deep expertise. For instance, if a founder has experience as a lawyer, the team may be building a legaltech startup. In this way, investors want to see that the founder understands the market, customer pain points, and competitive advantage of the product.

– Mission-driven Mindset: investors look for passionate and obsessed founders who are solving the world’s biggest problems with their technology. A strong personal connection to the problem often drives a founder’s determination & persistence. Moreover, the founder must be a compelling storyteller, able to articulate the vision of how their startup addresses the market gaps and aligns with long-term industry trends.

– Ability to Adapt & Learn: founders face new challenges daily, so problem-solving skills are crucial for navigating the ups and downs of startup life. As the startup evolves, some skills and traits may adapt along with the company stage, whether it’s building MVP, getting first paying customers, hiring first employee or scaling in new markets, having already a team of engineers, sales & marketing that require already solid management skills. However, at an early stage, investors want to help founders who are open to feedback, willing to learn, and can adapt to market shifts.

2. Balanced Founding Team

Ideally, the founding team should have a mix of business, technical and sales/marketing skills. You can do it as a solo founder, however having at least two co-founders with complementary skill sets is encouraged. For instance, let’s describe the technical part. Product development can be accomplished in three ways:

a. Founders who are developers (UX/UI Designer, Software Engineer)

b. Founders who hire developers

c. Founders who outsource development to a third party

The cost to the company increases dramatically as you move from a to b to c. Startups that outsource development burn money faster than those with technical founders who tend to survive difficult periods more easily while maintaining product velocity.

Additionally, having a founder with sales or marketing experience can accelerate early customer acquisition by identifying the right target customers, sales channels, and pricing models, ultimately proving the product’s viability. This foundation will help establish the necessary sales processes, tools, and teams as the company grows.

3. Traction

At Mozaic, there isn’t a specific benchmark for traction, however we do want to see some validation, whether it’s paying customers, active user growth or waiting list. Traction is one of the most critical criteria for our angel investors when evaluating a startup for investment. It serves as proof that the startup’s product or service has demand in the market and that the team can execute their vision effectively. Especially at early-stage, having any revenue, even a small amount, is a strong indicator of traction, reducing the perceived risk for angel investors. If customers are already buying or using the product, it signals that the market believes in its value. For startups that are not yet generating revenue, a rapidly growing user base or engagement metrics can also be a compelling form of traction. Investors look for metrics such as daily or monthly active users, sign-ups, retention rates, and usage frequency.

4. Scalable Business Model

Our angel investors seek products or services that can scale effectively. The best way to achieve this is by building products with zero or near-zero marginal costs for reproduction. This means that once the initial product is built, the cost of creating additional units or serving more customers is minimal. Startups should focus on creating products or systems that can grow exponentially without a proportional increase in maintenance efforts. In this context, we mostly target software, B2B SaaS, vertical AI, platforms, niched marketplaces, focusing on recurring revenue models. Writing code or building software is highly scalable; once it’s done, it can be sold or used by millions without additional effort. Similarly, creating content such as books, videos, podcasts, or blogs shares the property of infinite scalability, as the distribution costs are minimal. This allows startups to leverage technology and reach larger audiences at low marginal costs.

5. Market Opportunity

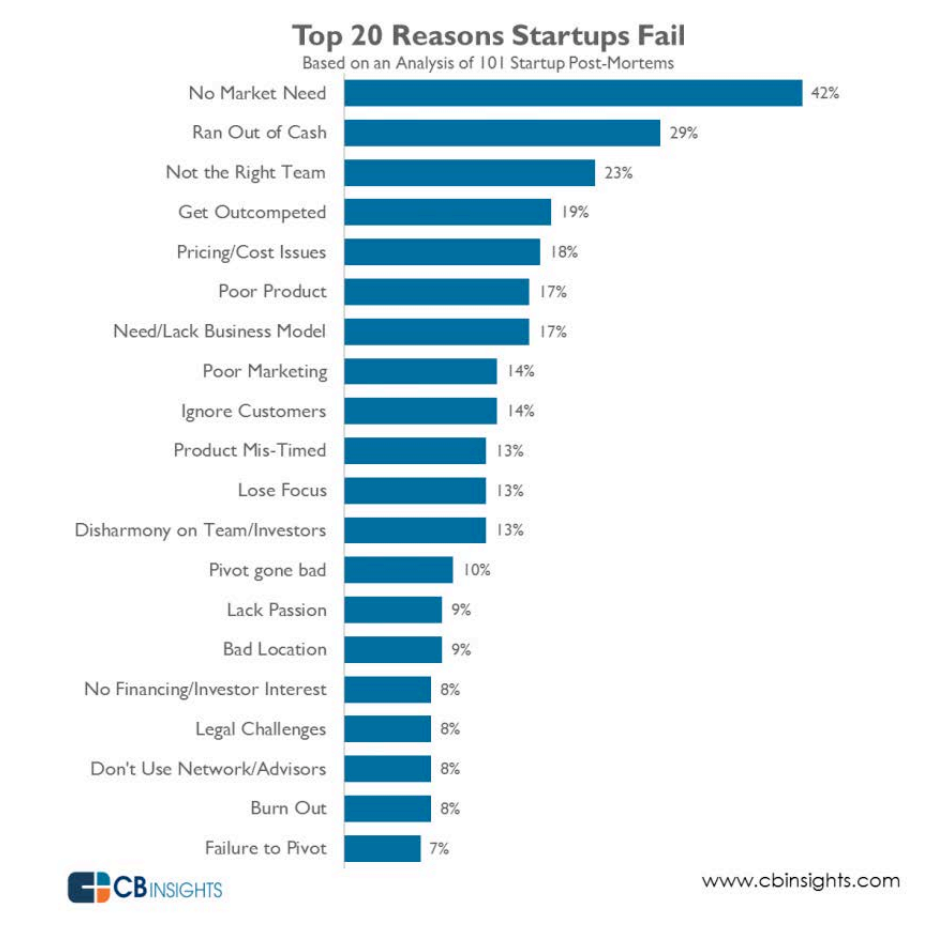

According to CB Insights Report, 42% of startups fail, because there is no market need. While the percentage may vary across multiple studies, this reason consistently emerges as a critical factor.

Startups must ensure they are building something that meets market demand. In addition to traction, angel investors look for a big and growing market—at least a $1 billion market with 20% annual growth. However, market size should correlate with the quality of the founding team. For example:

- Great Team + Small market: The team’s skills may lead them to expand the market or find new opportunities, transforming small into something bigger. It can be a smart strategy where it allows the team to dominate that market, build a loyal customer base, and create strong brand recognition without having to compete with larger, established players. However, it can lead to pivoting to a more lucrative market or refining product offering.

An example is Slack. Slack started as a side project while the company was building a game. When the team realized that their game wasn’t gaining traction, they pivoted to focus on the internal communication tool they had developed for themselves. They turned what seemed like a small market for team chat into a massive opportunity.

- Good Team + Big Market: While they might achieve some level of success, they are less likely to become market leaders due to limitations in execution or innovation, making this option less attractive to investors.

- Great Team + Big Market: This is the ultimate combination, where the team’s excellence and the large market opportunity together create the highest potential for exponential growth and success.

An example is Google. Google started in a big market (search engines and the growing need for information retrieval). The founders’ technical excellence and innovation created a search algorithm that was far superior to anything else available at the time. As they expanded into the online advertising market, which was huge and rapidly growing, they dominated with their highly scalable AdWords platform. The combination of a great team and a massive market opportunity led Google to become one of the world’s most valuable companies.

Conclusion

While the criteria outlined in this analysis are vital for assessing a startup’s potential, many nuances exist in each investment opportunity. By carefully evaluating these elements, angel investors can make informed decisions that enhance their chances of backing startups ready for significant growth while supporting ventures aimed at making a positive impact on the world.

If you want to get more info about our Mission & Investment Thesis, check this blog post.